Once the schedules have been approved and validated you can move the process to the next step, payroll processing and posting. This is done by a function called Get Schedule Entries. The function goes through the shift activities and populates lines on the Payroll Journal based on certain filters.

Generating a Payroll Run

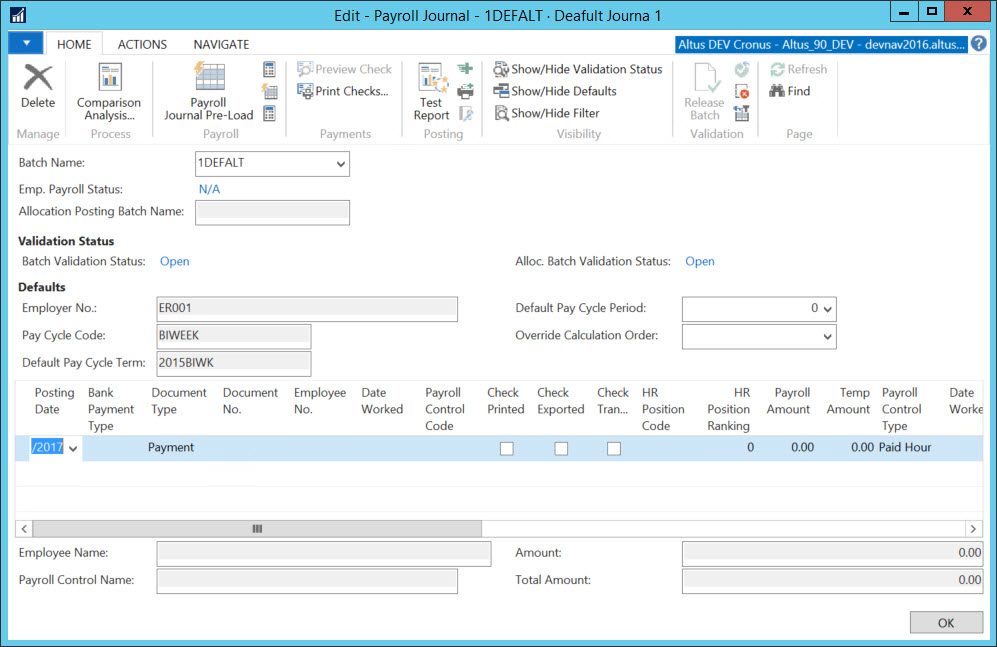

Payroll processing takes place within the Payroll Journal. Generally the entire payroll generation process is run by Pay Period in a batch. The appropriate batch is loaded using the Get Schedule Entries for the one pay period, then the payroll calculation is run, and finally a test report is run for the entire batch.

Pre-defined batches include the details for the payroll run (payroll, vacation accrual, etc.) you want to calculate. Creating batches (Journal Templates) helps you save time when running the payroll calculation and eliminates errors and omissions.

Defining the Parameters to Include in the Payroll Generation

Each time a payroll run is generated, the last batch generated is automatically selected. If you require a different batch to be run, the appropriate batch must be selected from the list of pre-defined Journal Templates.

The Payroll Journal window also contains fields and filters for customizing the payroll run to include the employees, payroll controls, and time frame you want to calculate.

To define the options for the payroll generation:

- In the search field type Payroll Journals.

- The Payroll Journal Template List opens.

- Select the record for the payroll journal you want to open.

- Click OK.

- The Payroll Journal window opens.

- In the Batch Name field, click the drop-down.

- The Payroll Journal Batches window opens.

- Select the batch you want and click OK.

- In the Default Pay Cycle Period field, enter the default pay cycle period or select it from the drop down.

- In the Override Calculation Order field, select a value if applicable.

Adding Schedule Entries

You can add the activities of the approved and validated shifts to payroll and edit them as required to ensure the payroll processes successfully.

To create and edit entries:

- In the Payroll Journal, from the Payroll section of the Actions ribbon click the Get Lines drop down.

- From the drop down select Get Schedule Entries.

- The Get Schedule Entries displays.

NOTE: The Get Schedule Entries function uses filters on scheduled shifts in order to populate lines on the Payroll Journal with the activities breakdown of these shifts.The criteria for pulling the shift activities is described in Filtering Shifts for Payroll Processing. - Expand the Schedule Line Details fast tab and select the appropriate filters (different filters can be set to find or process specific records) to verify the required data to generate the payroll run.

- Expand the Options fast tab.

- In the Pay Cycle Code field, click the drop down and select the appropriate Pay Cycle Code.

- In the Pay Cycle Term field, click the drop down and select the appropriate Pay Cycle Term.

- In the Pay Cycle Period field, click the drop down and select the appropriate Pay Cycle Period.

- The other fields are populated by default.

- Click OK to close the Get Schedule Entries window.

- The Payroll Journal window re-opens and the employees with shifts for the pay cycle you selected, display, including all the payroll controls for each of these employees.

Calculating Pay

Once you confirm that all the required data for the employees contained within the payroll you want to generate is provided (see, Defining the Parameters to Include in the Payroll Generation for steps and details), you can begin the process of calculating pay for these employees.

To calculate pay:

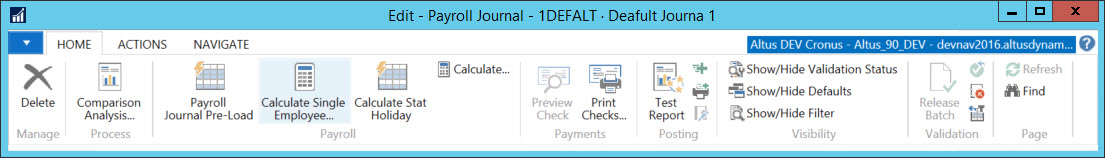

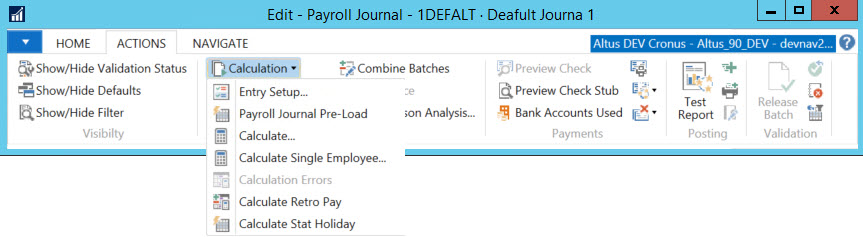

- In the Payroll Journal, click the Calculate button drop-down from the Payroll section of the Home ribbon.

NOTE: You can select the Calculate Single Employee button to recalculate one employee after making changes to one of the Payroll Controls. For details and steps, see Calculating Pay for a Single Employee.

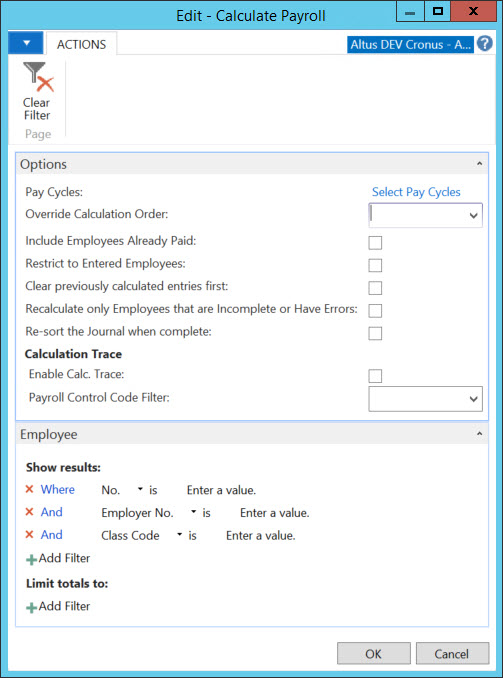

- The Calculate Payroll window opens.

- From the Employee fast tab, if a filter exists in the No. field, remove it.

- Expand the Options fast tab.

- Check the Restrict to Entered Employees box.

- Check the Clear previously calculated entries first field ONLY if changes were made to more than one employee. (If changes are made and this box is not checked, the old calculations are not cleared and the new calculations do not occur.).

- Check the Re-sort the Journal when complete field. (As an employee's pay is being calculated, new lines are being added to the journal for each Payroll Control (deductions, taxes, etc.). By re-sorting, you group all of the employee's entries together. Without the re-sort, an employee's transactions are randomly scattered in the journal.).

NOTE: When you are determining whether to use the re-sort function, you need to take the following into account:

The number of employees contained in the payroll run. If there are many employees, you may not want to re-sort because there is a considerable performance impact.

Although cheque printing and posting tasks do not require the re-sort, it does make it easier to review the Payroll Journal. - Click OK.

- The Payroll Journal calculates.

- In the confirmation window (which details the calculation actions, errors, warnings, etc.), click OK.

- The Payroll Journal populates with the payroll control values assigned to the employee’s record.

Note: Once the calculation is successfully completed (errors resolved) you can print cheques and process direct deposit transmissions, if required. For details and steps, see Testing the Payroll Calculation and Resolving Errors.

Calculating Pay for a Single Employee

If you detect an omission (perhaps overtime for an employee was not recorded during the initial setup), you can make this change and then recalculate for only that employee. The Calculate Single Employee option only calculates the selected employee. The single employee function is useful in the event that you make an error or forget something, you do not have to invest considerable time in recalculating all employees.

To calculate pay for a single employee:

- In the Payroll Journal, click the Calculate Single Employee button from the Payroll section of the Home ribbon.

- The Calculate Payroll window opens.

- If a filter exists in the No. field, remove it.

- Click the Options tab.

- In the Options tab, select the Re-sort the Journal when complete. (The other check boxes can be left the way they are).

NOTE: To save even more processing time, when you have multiple employees to recalculate, only select the re-sort when recalculating the last employee. - Click OK.

- The Payroll Journal calculates.

NOTE: Once the process is initiated, a verification of the entry is performed to ensure the correct sign (positive or negative) for the type of item is provided. For example, if you try to change a control (enter a deduction, such as a tax), when the verification is performed, you receive a warning if you did not use the appropriate sign. In the case of a deduction, the number must be a negative.

Testing the Payroll Calculation and Resolving Errors

Running a Test Report

Once you calculate payroll, it is a good practice to run a Test Report to determine if there are any errors. This way, you can resolve any errors and save time before you begin the check printing process.

To run a test report:

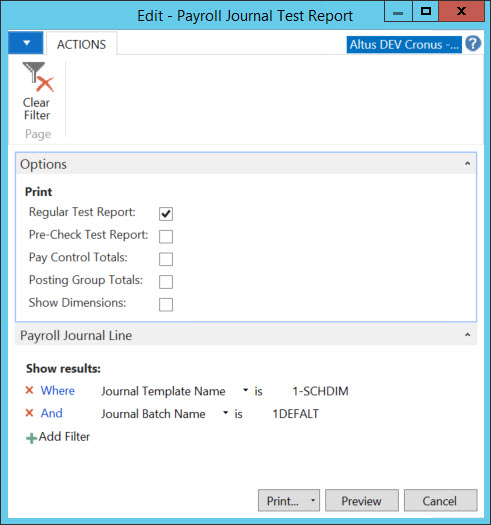

- In the Payroll Journal window, click the Test Report button from the Posting section of the Home ribbon.

- The Payroll Journal Test Report window opens.

- From the Options fast tab check the Pre-Check Test Report box. (Since you are yet to print the cheques, you want to use the Pre-check option for running the test report.)

The print option selected by default is Regular Test Report.

NOTE: The following warning messages display on each line of the report if you leave the default option Regular Test Report selected:

Warning! “Check Printed must be Yes when Bank Payment Type is “Computer Check” and,

Warning! “Document No. must be specified.”

These errors are generated because the checks are not yet printed. - Click the Preview button.

- A preview window opens displaying the test report.

- If any errors do occur, you need to review the content of the message and return to the Payroll Journal window to review more details for the errors and to resolve the outstanding issues before you re-calculate the payroll run. See the next section for details on error resolution.

- Close the Preview window.

- If after reviewing the test report you determine that everything calculated correctly, then you can transmit the EFTs (Payroll, Electronic Payments, Export, and then Transmit) and the payroll is posted.

Resolving Calculation Errors

When errors occur during the payroll calculation, you can review the errors to determine the cause and then resolve the errors. Calculation errors are displayed by batch or by a single employee.

To resolve calculation errors:

- Click the Calculation drop down from the Payroll section of the Actions ribbon, and select Calculation Errors.

- The Payroll Errors window opens displaying the errors generated during the calculation process.

- Resolve any errors.

- Close the window and re-calculate the payroll. For details see, the Calculating Pay section.

- For further details regarding posting, you can refer to the Payroll Setup and Guide.

Filtering Shifts for Payroll Processing

When entries are pulled to the Payroll Journal, the data is filtered based on specific criteria to ensure only the needed information is transferred and posted into Payroll.

Shifts

The payroll engine filters shifts based on the following criteria:

- Validation status Validated.

- Status Approved.

- Work Date should be less than or equal to the Pay Cycle Period End Date.

- The type of the schedule line should be Employee.

Employee Assignments

The payroll engine tries to identify an active assignment for the employee based on the work date and the position selected on the shift. The matching is done based on the following criteria:

- Employee No.

- HR Position Code

- Shift (Work Date to be between the HR Position Ledger Entry): Calculation Start Date and End Date

- Assignment: Employer No. equals to the Employer No. from the Payroll Journal Header

- Assignment: Entry Type = Assignment

- Assignment: Pay Cycle Code = Pay Cycle Code from the Payroll Journal Header

Populating the Payroll Journal Lines

When Schedule Entries are transferred to the Payroll Journal through Get Receipt Lines certain fields on the Payroll Journal are populated based on the information from Schedule Lines.

| Payroll Journal | Shift/Activity |

| Date Worked | Shift Work Date |

| Employee No. | Shift Employee No. |

| Payroll Control Code | Activity Payroll Control Code |

| Payroll Amount | Activity Quantity |

| Dimensions | from the Dimensions linked to the Activity |

| Generated from Schedule = True | When an entry is created through Get Schedule Entries |

Updating Statuses of Shifts

When schedule entries are transferred to Payroll:

- The statuses on the shifts are changed to All Transferred

- The shifts become non-editable

If a Payroll Journal Line is deleted and has a flag that it is generated from a Schedule, we will check if there is more than one activity for that shift. If more than one activity exists all activities linked to this shift will be deleted to allow you to edit the shift in its entirety.

- The status is changed back to Approved

- The shift becomes editable

When the Payroll Journal is posted:

- The statuses on the shifts are changed to All Posted

- The shifts are non-editable