Any hours over the overtime threshold worked per week should be paid at an overtime rate. In Canada, the threshold varies by province and the overtime rate is simply 1.5 times the hourly rate on the Assignment where overtime was worked. In the US, the overtime rate is the calculated blended rate (average) of all eligible earnings for the week times 1.5.

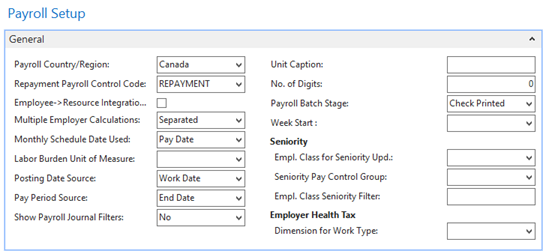

Configuring Payroll Setup

- In the Search field, type Payroll Setup and then select the page from the drop-down list.

The Payroll Setup page displays.

- In the Week Start field, specify which day is the start of the work week in your organization.

- Click OK.

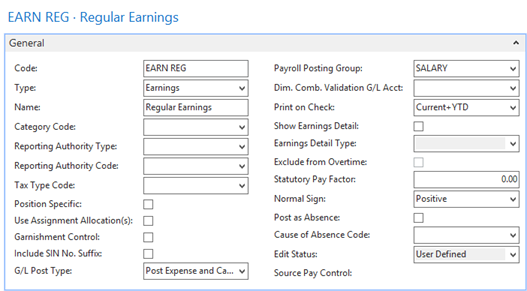

Configuring Payroll Controls

For each of your payroll controls, specify if it is overtime-eligible:

- In the Search field, type Payroll Controls and select the page from the drop-down list.

The Payroll Controls list displays. - Select the Payroll Control that you want to modify, and from the Ribbon click Edit.

The Payroll Control card displays.

- For each control that you want to update, add a checkmark to the Exclude from Overtime check box if the control is not overtime-eligible.

Note: This field is enabled on Paid Hour payroll controls only. Typically, this new field would be True on all hourly paid hour controls that should not be considered when determining if the employee exceeded the overtime threshold in a work week. Examples might be for paid sick and vacation hours. - Click OK.

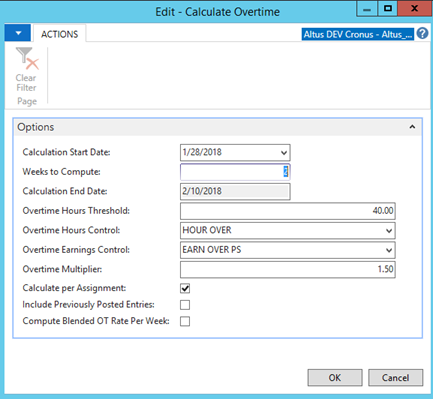

Calculating Overtime

To calculate overtime:

- In the Search field, type Payroll Journal and select the page from the drop-down list.

The Payroll Journal Template List displays. - Double-click the appropriate Payroll Journal.

- From the Actions tab, click Calculation and then click Calculate Overtime.

The Calculate Overtime page displays.

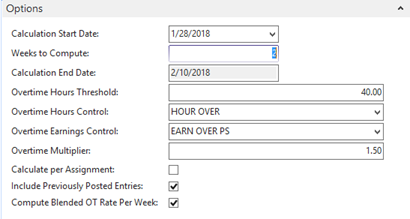

- Complete the page as follows:

- Calculation Start Date: The Calculation Start Date must begin on the same day as the Week Start field on the Payroll Setup page.

- Weeks to Compute: Enter the number of weeks (from two to eight) that after the Calculation Start Date to compute overtime (using Date Worked).

- Calculation End Date: This value is automatically determined from the Calculation Start Date and the Weeks to Compute.

- Overtime Hours Threshold: Enter the hours per week before overtime is computed. Typically, values like 40 or 44 should be entered here.

- Overtime Hours Control: Select the Paid Hours control that will be used for overtime hours (e.g. HOURS OVER).

- Overtime Earnings Control: Select the Overtime Earnings control that is used for overtime calculations. If left blank, the related Overtime Earnings records are created during the main calculation process.

- Overtime Multiplier: If an Overtime Earnings Control has been entered, specify the applicable overtime multiplier (for example, 1.5).

- Calculate per Assignment: Add a checkmark to this check box to view each assignment separately to determine if the threshold has been exceeded. If not checked, all hours, regardless of assignment, will be considered to determine if the threshold has been exceeded.

- Include Previously Posted Entries: If checked, based on Date Worked, the system will consider previously posted paid hour records when determining if the threshold has been exceeded.

- Compute Blended OT Rate Per Week: Use this option to compute a blended rate across all qualified overtime hours before the overtime multiplier is applied.

- Click OK.

When the system calculates overtime, it checks for the following issues before proceeding:

- If the Calculation Start Date or Weeks to Compute is not filled.

- The Overtime Hours Threshold is set to zero.

- The Overtime Hours Control has been left blank.

- The Calculate per Assignment and Compute Blended OT Rate Per Week have both been checked (why blend rates between assignments when determining OT separately).

- If Compute Blended OT Rate Per Week is checked, the Overtime Earnings control cannot be left blank nor can the Overtime Multiplier be left at zero.

This batch report process the data in three phases:

- Phase I - Load the existing payroll journal into temporary tables and delete the entire journal.

- Phase II - Determine overtime hours (and optionally overtime earnings).

- Phase III - Re-load data in temporary tables into actual Payroll Journal.

Calculation Examples

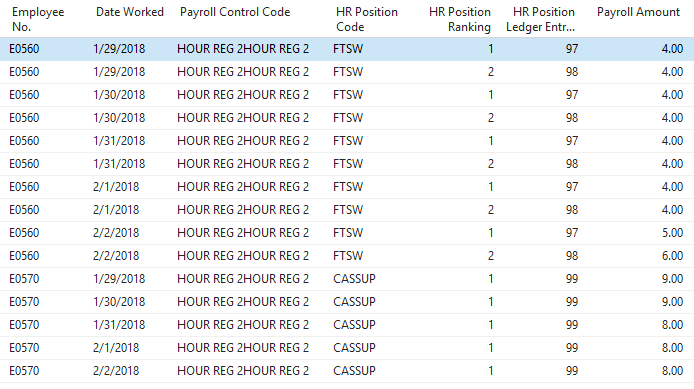

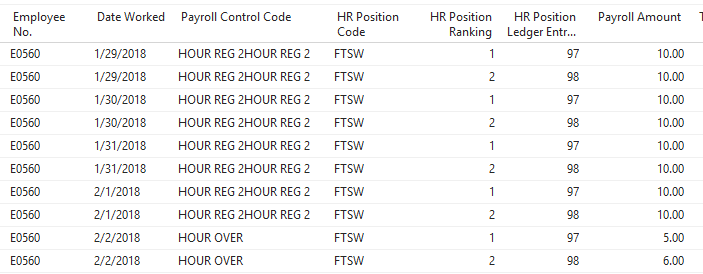

The calculation examples provided below use the following data set:

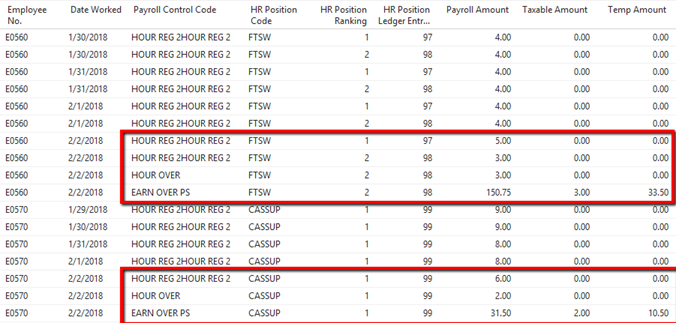

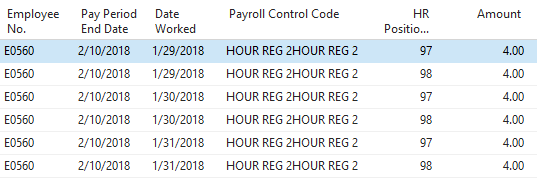

Example 1 – No Overtime Earnings Created

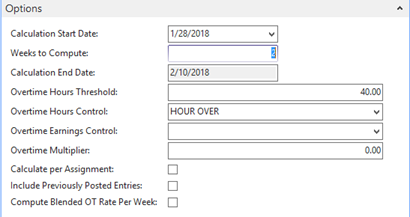

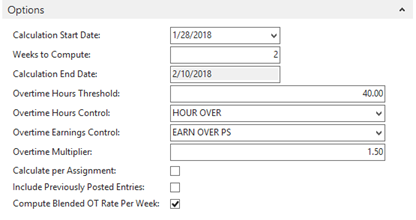

In this example, it is assumed that overtime will be added in the main payroll calculation (OT is not per assignment). Run Calculate Overtime with following settings:

These settings produce the following results:

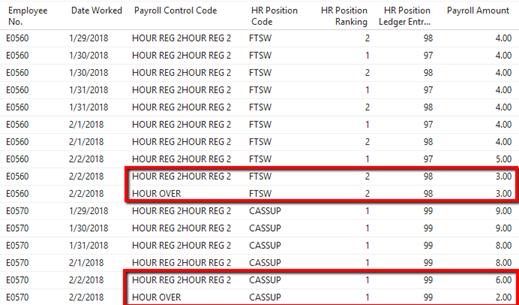

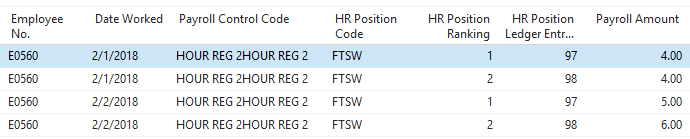

Example 2 – Overtime Earnings Created without Blended Rates

In this example, overtime is not calculated per assignment, and blended rates are not used. Run Calculate Overtime with following settings:

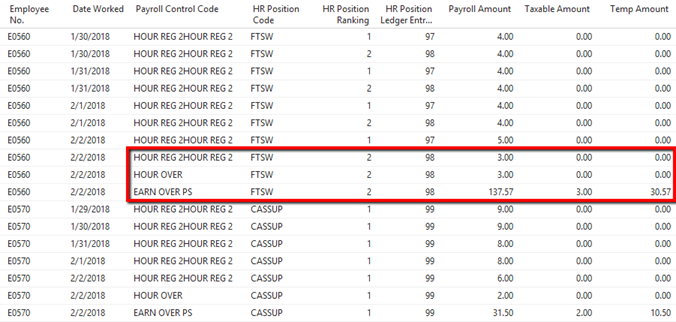

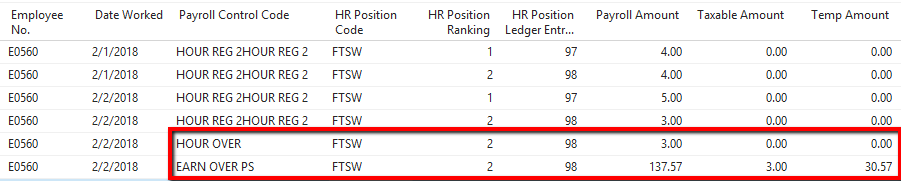

These settings produce the following results (some top rows have been left off due to excessive screen size):

Notice that the system for E0560 used PLE 98 for the overtime and its related pay rate. This is since it was the last record in the data - the system works backward to determine which records are converted to overtime.

Example 3 – Overtime Earnings Created with Blended Rates

In this scenario, the overtime function brings the regular hours down to the threshold value and inserts new records representing the overtime hours (hours over the threshold) and overtime earnings. This occurs for each week where hours exceed the overtime threshold specified on the Report Request page. The overtime earnings calculated will use a blended or average rate from all positions worked during the period where the employee earned overtime.

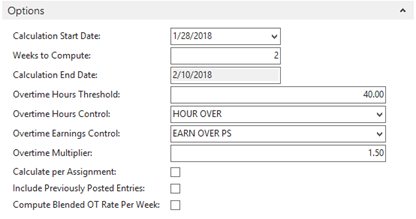

Run Calculate Overtime with following settings:

These settings produce the following results (some top rows have been left off due to excessive screen size):

Notice the hourly rate of $30.57 - this is a blended rate computed as follows:

- Assignment 97 = 21 hours x $27.50 per hour = $577.50

- Assignment 98 = 22 hours x $33.50 per hour = $737.00

- Blended rate = $577.50 + $737.00 / 43 hours = $30.57

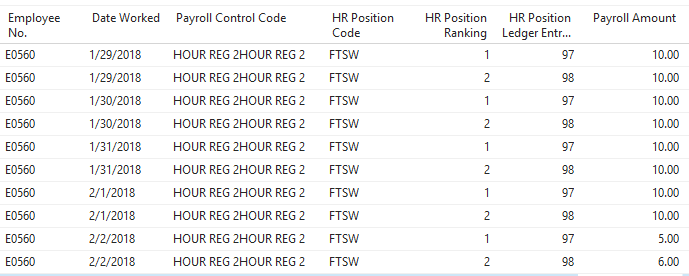

Example 4 – Overtime is Computed per Assignment – using Blended Rates is not Allowed

In this scenario, the overtime function brings the regular hours down to the threshold value and inserts new records representing the overtime hours (hours over the threshold) and overtime earnings. This occurs for each week where hours exceed the overtime threshold specified on the report request page. The overtime earnings calculated will use the position rate x multiplier where the employee exceeded the weekly overtime threshold.

Before data:

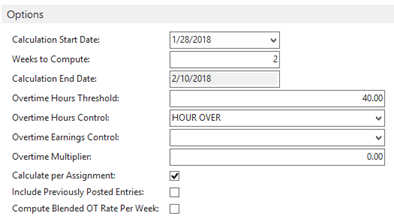

Run Calculate Overtime with following settings:

These settings produce the following results:

Notice that the system created OT for both assignments. If the earnings are created, the system uses the hourly rate for each position (no blending is supported in this mode).

Example 5 – Previously Posted Entries are Considered

The following is an example of data previously posted into the Payroll Ledger:

Before data in the journal:

Run Calculate Overtime with following settings:

Results:

Notice how the system used the 24 hours that have been previously posted to determine that the employee had a total of 43 hours (24 previous + 19 current) for the week. Also, notice that the system considered the previously posted entries to correctly determine the blended hourly rate.