Note: This page reflects changes to Ontario's Statutory Holiday Pay regulations, which are effective July 1st, 2018.

Overview

The purpose of this document is to explain the configuration steps required to set up statutory holiday pay in Ontario and Manitoba. Once configured the statutory pay calculation will be part of your regular payroll process.

Statutory holiday pay is calculated using the EARN STAT PAY payroll control. This control will use one or more of the following method steps: ADD STAT TO TAX JNL, ADD STAT TO TAX LEDG or AMOUNT IS STAT PAY. The method steps used will depend on the province.

Use the following steps to configure statutory holiday pay in Ontario and Manitoba:

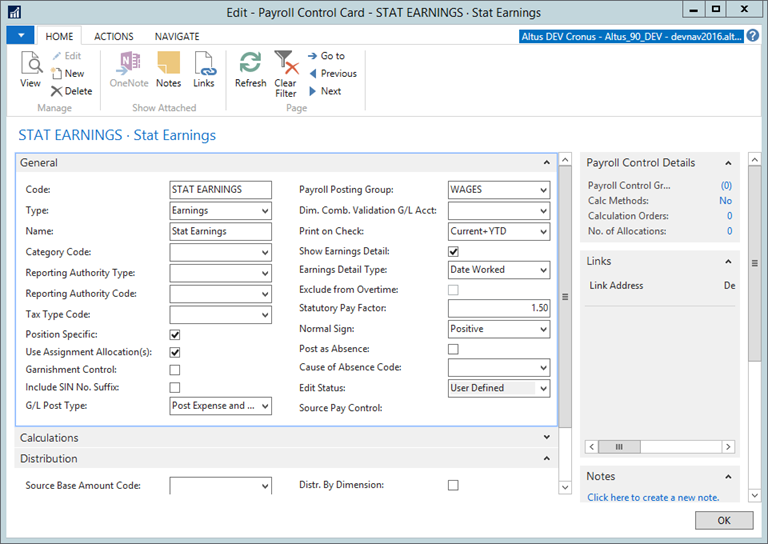

Populate the Statutory Pay Factor Field

On the statutory pay eligible earnings payroll controls, populate the Statutory Pay Factor field with 1.0 for regular earnings; 1.5 for any overtime earnings. When Statutory Pay Factor is greater than 1.0, it is used to normalize earnings to remove overtime or other pay that is a multiplier of base. Normally, the Factor will be 1.0 in the case of regular earnings and will be 0 to exclude those earnings from being included in the statutory pay calculation.

- In the Search field, type and then select Payroll Controls.

The Payroll Control List displays. - Select the statutory holiday pay-eligible payroll control and expand the General FastTab.

- In the Statutory Pay Factor field, specify one of the following:

- 0: This payroll control is excluded from statutory holiday pay calculations.

- 1: This payroll control is considered as regular earnings in statutory holiday pay calculations.

- 1.5, 2.0, etc: Set this to your overtime multiplier (to represent time and a half, double time, and so on) in order to normalize the overtime earnings. The system will remove the overtime premium earnings and only report on the regular earnings. If your overtime earnings are calculated under a separate payroll control, then you can simply leave the Statutory Pay Factor field as 0 so those earnings will not be included in the calculation.

- Click OK.

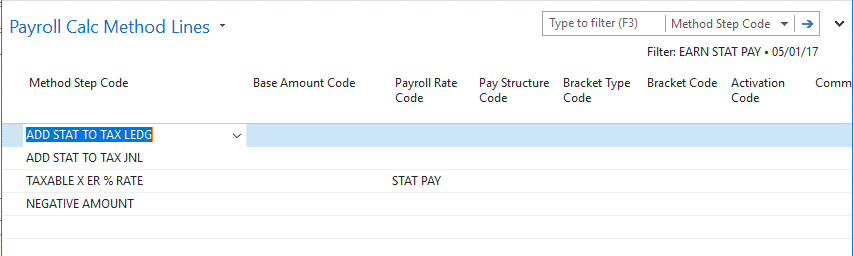

- Expand the Distribution FastTab and do the following:

- Select the Source Base Amount Code. If you do not have one, then you will need to create one.

- Add a checkmark to the Distr. By Date Worked checkbox.

- Repeat steps 3-5 for each statutory holiday pay-eligible payroll control.

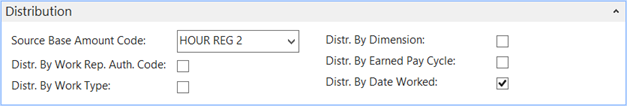

Create a New Earnings Payroll Control

Create a new earnings payroll control for the statutory pay earnings. You can copy an existing earnings payroll control and change the name and any other information on the new control.

- In the Search field, type and then select Payroll Controls.

The Payroll Control page displays. - From the Ribbon, click New.

The New Payroll Control card displays. - In the Code field type EARN STAT PAY.

- Click OK.

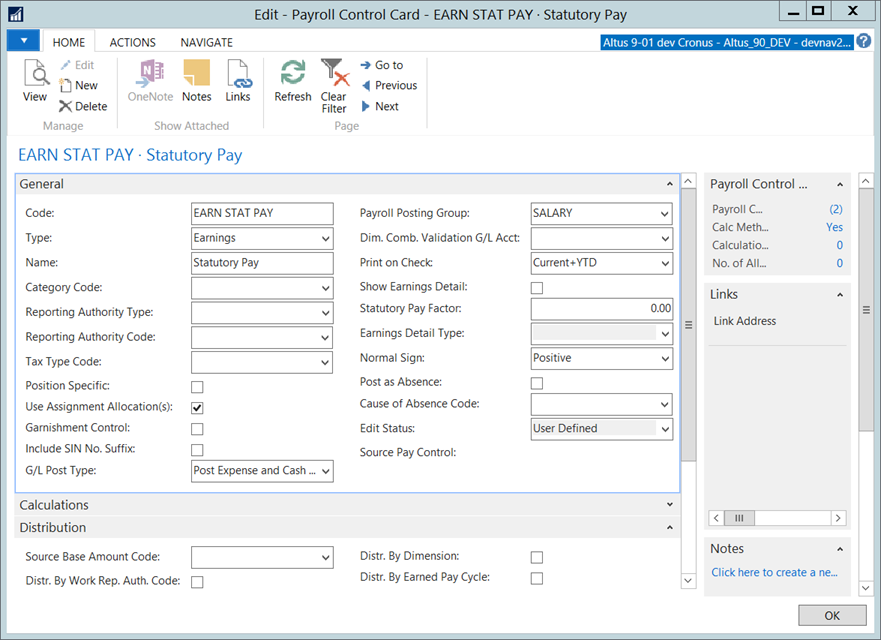

- The EARN STAT PAY control uses new method steps called ADD STAT TO TAX LEDG and ADD STAT TO TAX JNL:

- Description: Taxable is increased by Statutory Earnings using Payroll Ledger Entry records.

- Function No.: 2040

- Description: Taxable is increased by Statutory Earnings using Payroll Journal Line records.

- Function No.: 2041

- These method steps will only function if the new Stat Pay Calc. Method payroll setup field is set to Calculated from Prev. Earnings. If not, a zero will be returned.

The additional method steps used on the EARN STAT PAY control (in the above image) are there to complete the calculation. If the province requires a percentage of previous earnings then setup an Employer Rate to represent the percentage and use the TAXABLE X ER % RATE method step. If the province requires the previous earnings be divided by a number of days, setup an Employer Rate to represent the number of days as a fraction (for example, 1/20th) and use the TAXABLE X ER RATE method step.

Configure Payroll Setup

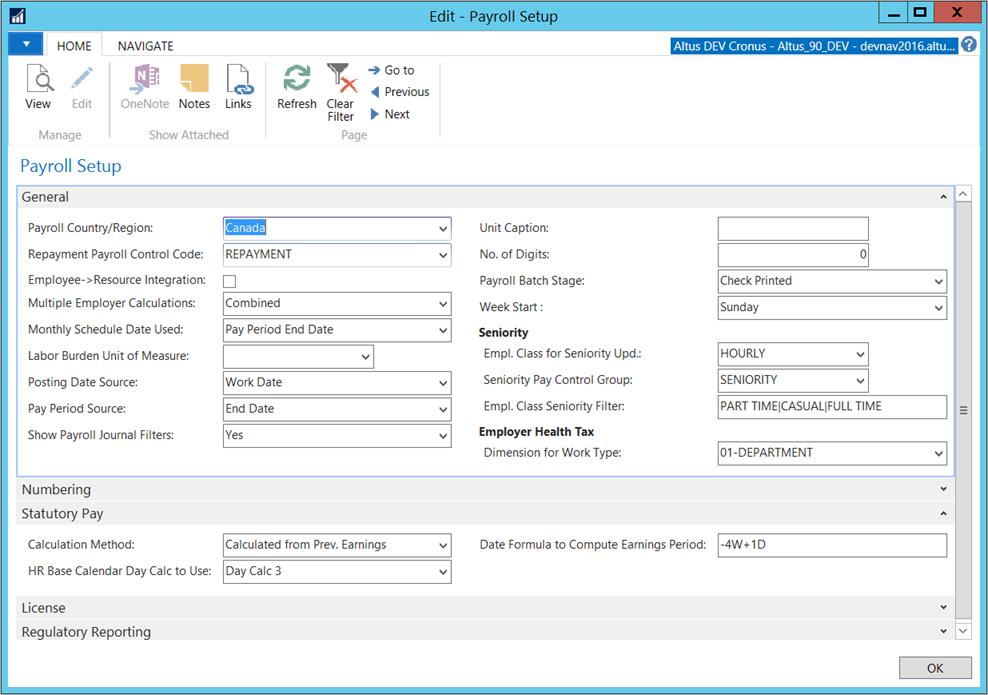

- In the Search field, type Payroll Setup and select the Payroll Setup page from the drop-down list.

The Payroll Setup page displays.

- Expand the General FastTab and complete the following:

- Week Start: Specify which day of the week begins your payroll week.

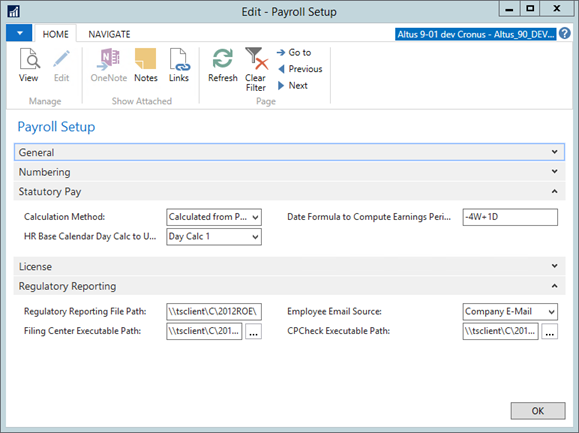

- Expand the Statutory Pay FastTab and complete the following:

- Calculation Method: set to Calculated from Prev. Earnings. The system will use the Payroll Setup fields Stat Pay Week Start and Stat Pay Date Calc. to determine the start date and end date values to use.

- HR Base Calendar Day Calc to Use: specify which Day Calc field in the HR Base Calendar indicates statutory holidays.

- Date Formula to Compute Earnings Period: specify a date formula that determines the start date of the statutory holiday earnings period from the end of the week prior to the statutory holiday.

NOTE: For example, Manitoba uses a formula of -4W+1D. When applied to 6/10/17, this would cause the Start Date to be set to 5/7/17.

- Click OK.

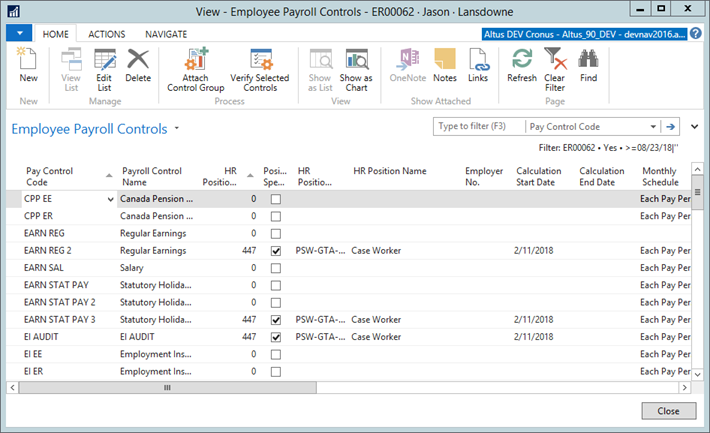

- Add the EARN STAT PAY payroll control to eligible employees and make it active.

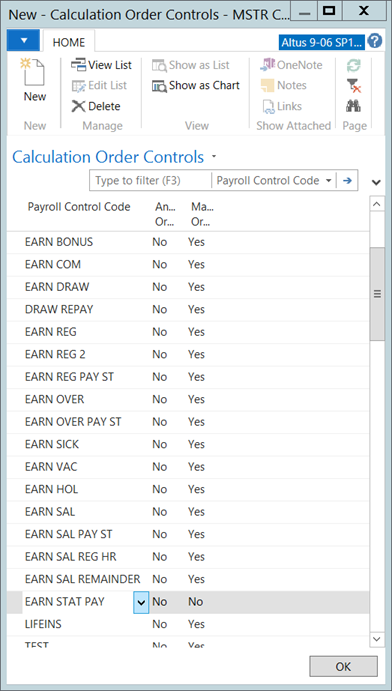

- Add the EARN STAT PAY payroll control to the calculation order.

Note: The statutory pay payroll control should appear as the last earnings payroll control.

Update the Calendar

Update the HR Base Calendar that is associated with the HR Positions that are eligible for Stat Pay.

- In the Search field, type and select HR Base Calendar.

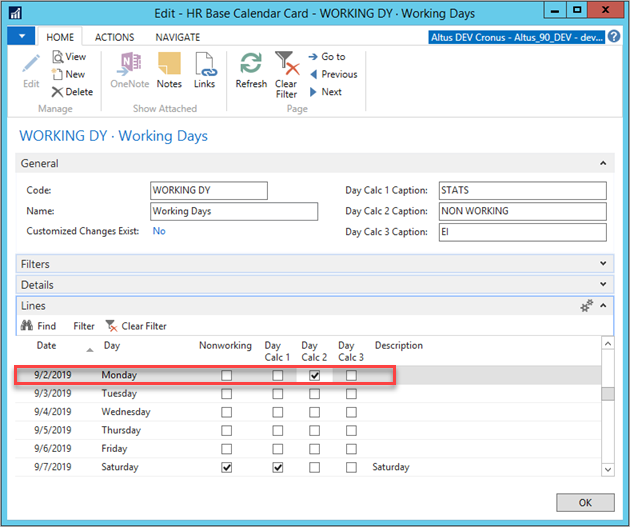

The HR Base Calendar page displays. - From the HR Base Calendar list, open the calendar that you use to keep track of your working days for each position which receives statutory holiday pay.

- Expand the Lines FastTab.

- For every statutory holiday, add a check mark to the Day Calc field checkbox that you specified (for example, Day Calc 3) on the Payroll Setup page.

Note: The Day Calc field used for the statutory days should not contain any other type of days; otherwise the system will think it's a statutory holiday and the employee should be paid for it.

- Click OK.

Payroll Calculation

Once you have configured payroll to calculate statutory holiday pay, statutory earnings are automatically calculated.

Once the system has established a start and end date for the statutory earnings period, it selects the proper table (either Payroll Journal Line or Payroll Ledger Entry) based on which method step is running. Records with a non-zero value for Statutory Pay Factor and True for Payroll Control Type = Earnings or Bonus are summed for each selected employee.

The system then adds the resulting value computed to the taxable amount for each statutory holiday found in the pay cycle period.