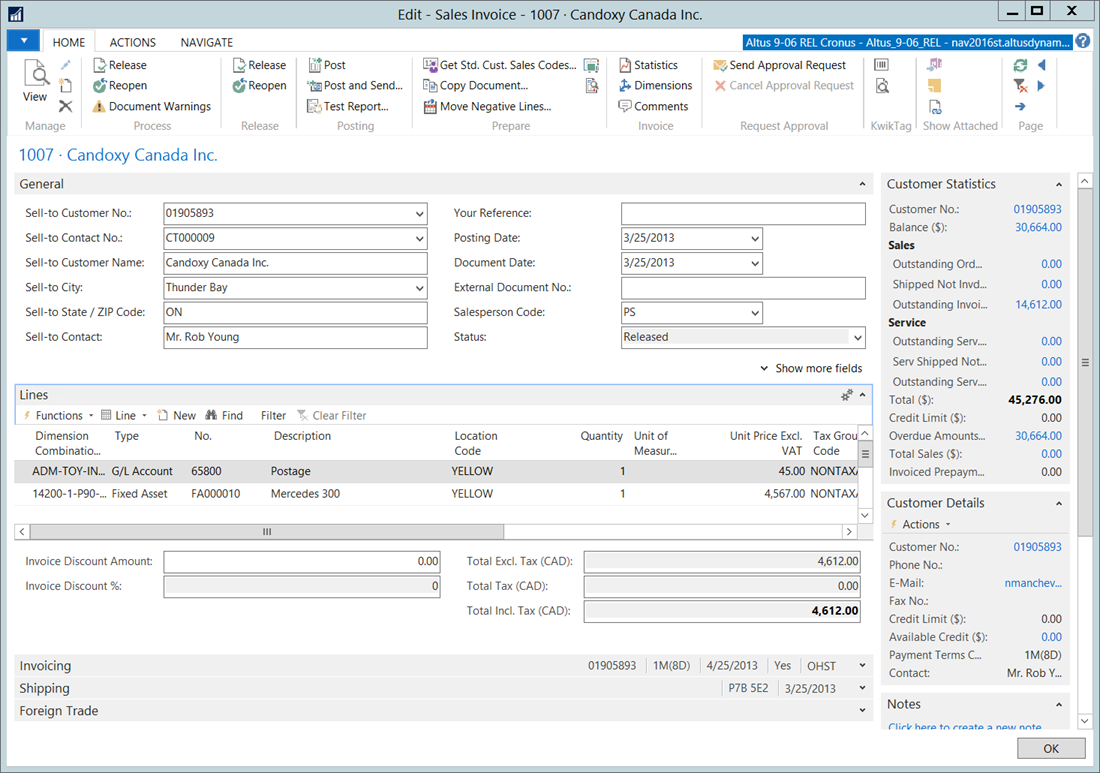

To access a sales invoice:

- In the Search field, type Sales Invoices and select the page from the drop-down list.

Note: You can also browse to the Sales Invoices Card by clicking Departments > Financial Management > Receivables > Lists > Sales Invoices. - Double-click an invoice to open the Sales Invoice Card.

- An invoice has a number of FastTabs, similar to that of the Customer Card, which has information populated or filled in, based on the tabs on the Customer Card that is selected for processing the invoice:

- General

- Lines

- Invoicing

- Shipping

- Foreign Trade

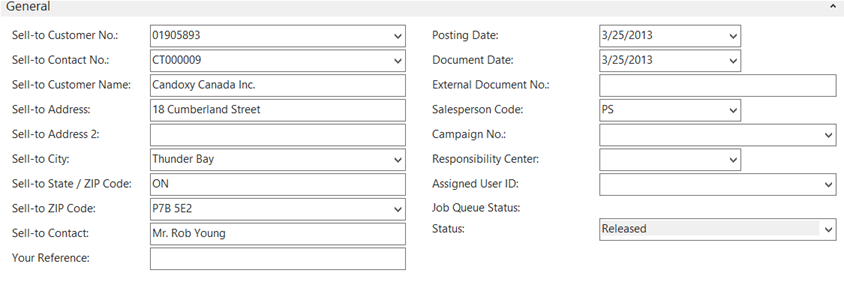

General FastTab

The General FastTab of the invoice specifies customer details and additional information that have been set up as default for the customer, for example, salesperson and responsibility center, which are copied from the customer card when the order is created.

Fields on the General FastTab are:

| Field | Description |

| Sell-to Customer No. | Specifies the customer number. |

| Sell-To Contact No. | Specifies the number of the contact that the sales document is sent to. |

| Sell-to Customer name and address information | Defaults from the Customer Card. Can be amended as needed. |

| Sell-To Contact | Name of the customer contact. |

| Your Reference | Specifies the customer reference number. |

| Posting Date | Date the invoice will be posted to the General Ledger. |

| Document Date | Date of the invoice. |

| External Document No. | Used for customer purchase orders or other reference. |

| Salesperson Code | Code for the salesperson associated with the customer. Defaults from the Customer Card. |

| Campaign No. | Not used. |

| Responsibility Center | Not used. |

| Assigned User ID | Specifies the user ID of the person who is responsible for the document. |

| Status | - Open - Changes can still be made to this invoice. - Released - the invoice is available for shipping. |

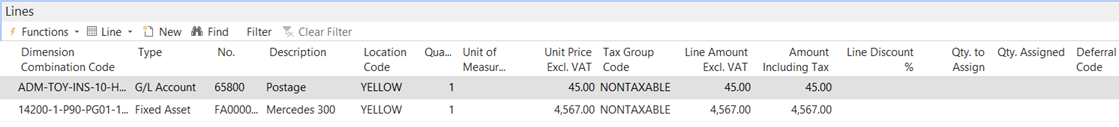

Lines FastTab

This is where you enter the details of what is sold.

Columns on the Lines FastTab are:

| Columns | Description |

| Dimension Combination Code | The dimension combination for the line item. |

| Type | In principle, a sales invoice can be used to register both a physical and financial transaction. The choice of transaction is defined by one of the following line type options:

|

| No. | This will be based on the Type selected. |

| Description | Defaults from the Item No. or G/L account no. which can be modified. |

| Location Code | Select the location code that inventory should be taken from. |

| Quantity | Quantity sold. |

| Unit of Measure | The unit of measure. |

| Unit Price excluding VAT | Unit price, not including VAT. Will default from the item card if a sales price has been entered. |

| Tax Group Code | Tax status of the item sold which defaults from the item card, GL account card and can be changed on this document. |

| Line Amount Excl. Tax | Extension of Quantity * Unit Price. |

| Line Discount % | Value of line discount % to be granted for this document. |

| Qty. to Assign | Specifies the amount of the item charge that will be assigned to a specified item when this sales line is posted. |

| Qty. Assigned | Specifies the amount of the item charge that was assigned to a specified item when this sales line was posted. |

| Deferral Code | Code used to represent the deferral conditions. |

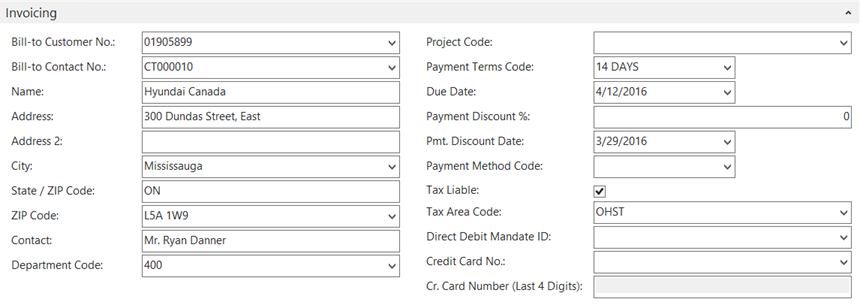

Invoicing FastTab

The fields on the Invoicing FastTab provide information related to the customer’s billing info, payment and tax info. The values in these fields are copied as default by the program from the Customer Card.

| Field | Description |

| Bill-To Customer No. | Customer number. |

| Bill-To Contact No. | Specifies the number of the contact where the invoice was sent. |

| Customer name and address information | Defaults from the Customer Card. Can be amended as needed. |

| Contact | Specifies the name of the customer. |

| Global Dimension 1 (Department Code) |

Global Dimension 1, from the General Ledger Setup page. |

| Global Dimension 2 (Project Code) |

Global Dimension 2, from the General Ledger Setup page. |

| Payment Terms Code | Specifies a code that indicates the customer's payment terms. |

| Due Date | Specifies the date when the invoice is due. |

| Payment Discount % | Specifies the possible payment discount percentage. |

| Pmt. Discount Date | Specifies the last date the customer can pay the invoice and still receive a payment discount. |

| Payment Method Code | Code that represents a payment method. |

| Tax Liable | Specifies whether the customer is liable for sales tax. |

| Tax Area Code | Specifies a tax area code. |

| Direct Debit Mandate ID | Specifies the ID of the direct-debit mandate that this standard customer sales code uses to create sales invoices for direct debit collection. |

| Credit Card No. | Specifies the customer's credit card number. |

| Cr. Card Number (Last Four Digits) | Specifies the last four digits of the customer's credit card. |

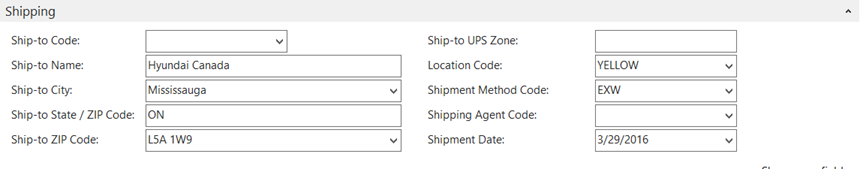

Shipping FastTab

The fields on the Shipping FastTab provide the possibility to further detail of the shipping-related information, for example, the customer’s alternative shipping address (Ship-to codes), shipment terms, agents, advice, ship-from location, shipment dates, and so on. The fields on the Shipping FastTab are:

| Field | Description |

| Ship-to Code | Specifies the code for the customer's shipment address. |

| Ship-to Name | Specifies the customer name for shipments. |

| Ship-to City | Specifies the city name of the address that products are shipped to. |

| Ship-to State | Specifies the State or Province where products are shipped for this customer. |

| Ship-to Zip Code | Specifies the zip code where products are shipped for this customer. |

| Ship-to UPS Zone | Specifies the UPS zone where products are shipped for this customer. |

| Location Code | Specifies the location code for this custoemr where products are shipped. |

| Shipment Method Code | Specifies the method of shipment. |

| Shipment Agent Code | Specifies the preferred shipping agent. |

| Shipment Date | Specifies the planned delivery date. |

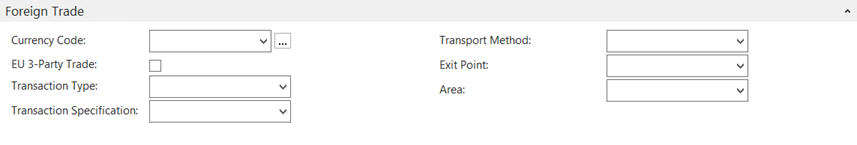

Foreign Trade FastTab

The fields on the Foreign Trade FastTab are used to manage the sale to a customer other than in the organization’s own currency, but also to manage the nature of the goods shipped and exported. The fields on the Foreign Trade FastTab are:

| Field | Description |

| Currency Code | Specifies the international three-digit code used to represent a foreign currency. For example, EUR for the Euro. |

| EU 3-Party Trade | Indicates if the sales document is part of a three-party trade. A three-party trade is where items are shipped to one country, while the invoice is sent to another country. |

| Transaction Type | Specifies details about the transaction. |

| Transaction Specification | Specifies additional transaction information for Intrastat reporting. |

| Transport Method |

Specifies the transportation method needed for Intrastat reporting. Possible values are: 1 – Sea |

| Exit Point | Specifies the code of the port of exit through which you ship items. |

| Area | Specifies a code for the area. |